Which County Has The Lowest Property Taxes In Georgia . The effective property tax rate is just 0.84%, well below the state. 160 rows this interactive table ranks georgia's counties by median property tax in dollars, percentage of home value, and. in georgia, for example, where the median property tax bill is relatively low, median taxes range from $494 in quitman. Then you need to know your effective property tax rate. 1 min read. you subtract your exemptions from your assessed value. the exact property tax levied depends on the county in georgia the property is located in. Fulton county collects the highest property. Poulan, sumner, sylvester and warwick. georgia has 159 counties, with median property taxes ranging from a high of $2,733.00 in fulton county to a low of $314.00 in warren county. property tax rates in cobb county rank among the lowest in the state. Smartasset’s latest study ranks the georgia counties with the lowest tax burdens, assessing income, sales, property, and fuel. This section provides information on property taxation in the various counties in georgia;.

from itep.org

The effective property tax rate is just 0.84%, well below the state. Then you need to know your effective property tax rate. you subtract your exemptions from your assessed value. in georgia, for example, where the median property tax bill is relatively low, median taxes range from $494 in quitman. 160 rows this interactive table ranks georgia's counties by median property tax in dollars, percentage of home value, and. This section provides information on property taxation in the various counties in georgia;. Poulan, sumner, sylvester and warwick. property tax rates in cobb county rank among the lowest in the state. Smartasset’s latest study ranks the georgia counties with the lowest tax burdens, assessing income, sales, property, and fuel. Fulton county collects the highest property.

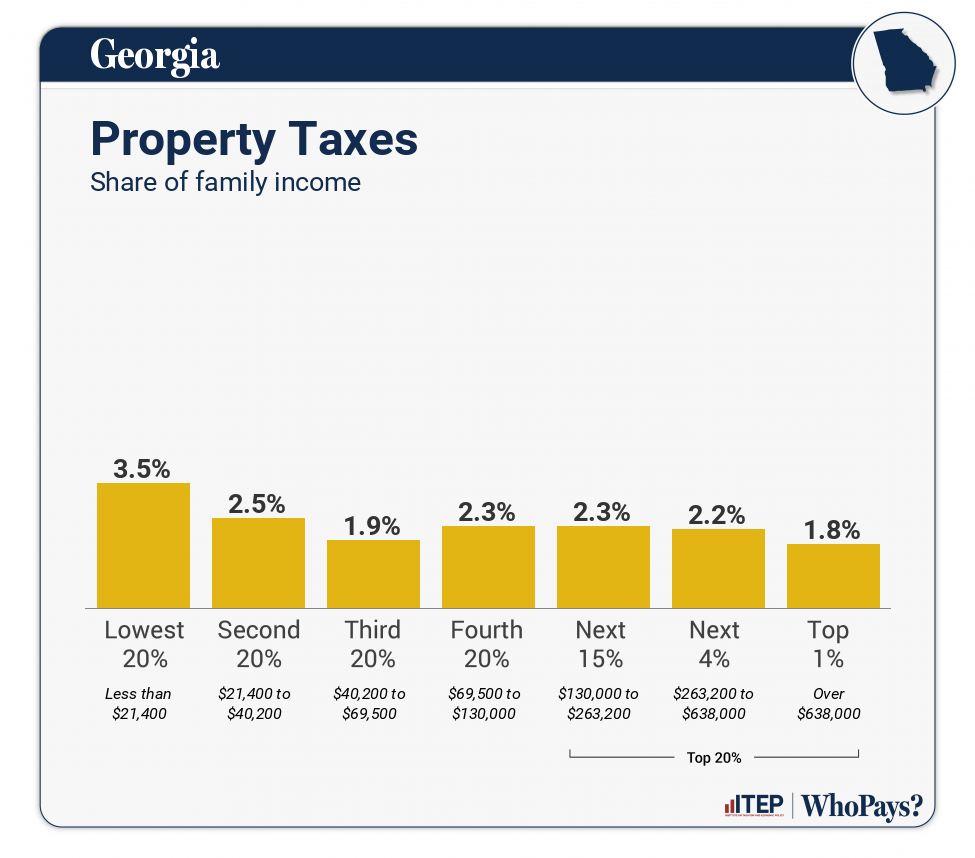

Who Pays? 7th Edition ITEP

Which County Has The Lowest Property Taxes In Georgia This section provides information on property taxation in the various counties in georgia;. Smartasset’s latest study ranks the georgia counties with the lowest tax burdens, assessing income, sales, property, and fuel. in georgia, for example, where the median property tax bill is relatively low, median taxes range from $494 in quitman. 1 min read. Poulan, sumner, sylvester and warwick. This section provides information on property taxation in the various counties in georgia;. Then you need to know your effective property tax rate. the exact property tax levied depends on the county in georgia the property is located in. property tax rates in cobb county rank among the lowest in the state. The effective property tax rate is just 0.84%, well below the state. georgia has 159 counties, with median property taxes ranging from a high of $2,733.00 in fulton county to a low of $314.00 in warren county. 160 rows this interactive table ranks georgia's counties by median property tax in dollars, percentage of home value, and. you subtract your exemptions from your assessed value. Fulton county collects the highest property.

From hubpages.com

Which States Have the Lowest Property Taxes? HubPages Which County Has The Lowest Property Taxes In Georgia The effective property tax rate is just 0.84%, well below the state. Fulton county collects the highest property. georgia has 159 counties, with median property taxes ranging from a high of $2,733.00 in fulton county to a low of $314.00 in warren county. This section provides information on property taxation in the various counties in georgia;. you subtract. Which County Has The Lowest Property Taxes In Georgia.

From cewhwirr.blob.core.windows.net

What State Has The Lowest Property Tax For Seniors at Harold Which County Has The Lowest Property Taxes In Georgia Then you need to know your effective property tax rate. Poulan, sumner, sylvester and warwick. the exact property tax levied depends on the county in georgia the property is located in. Fulton county collects the highest property. in georgia, for example, where the median property tax bill is relatively low, median taxes range from $494 in quitman. . Which County Has The Lowest Property Taxes In Georgia.

From taxfoundation.org

Property Taxes by State & County Median Property Tax Bills Which County Has The Lowest Property Taxes In Georgia Fulton county collects the highest property. 1 min read. in georgia, for example, where the median property tax bill is relatively low, median taxes range from $494 in quitman. This section provides information on property taxation in the various counties in georgia;. Then you need to know your effective property tax rate. the exact property tax levied. Which County Has The Lowest Property Taxes In Georgia.

From agraynation.com

Senate 24 Which County Has The Lowest Property Taxes In Georgia Smartasset’s latest study ranks the georgia counties with the lowest tax burdens, assessing income, sales, property, and fuel. 1 min read. in georgia, for example, where the median property tax bill is relatively low, median taxes range from $494 in quitman. you subtract your exemptions from your assessed value. 160 rows this interactive table ranks georgia's. Which County Has The Lowest Property Taxes In Georgia.

From www.infographicbee.com

What Are the Cities with the Highest and Lowest Property Taxes in the Which County Has The Lowest Property Taxes In Georgia Smartasset’s latest study ranks the georgia counties with the lowest tax burdens, assessing income, sales, property, and fuel. Poulan, sumner, sylvester and warwick. georgia has 159 counties, with median property taxes ranging from a high of $2,733.00 in fulton county to a low of $314.00 in warren county. Fulton county collects the highest property. 1 min read. . Which County Has The Lowest Property Taxes In Georgia.

From www.easyknock.com

What is the Property Tax Rate in EasyKnock Which County Has The Lowest Property Taxes In Georgia 160 rows this interactive table ranks georgia's counties by median property tax in dollars, percentage of home value, and. property tax rates in cobb county rank among the lowest in the state. georgia has 159 counties, with median property taxes ranging from a high of $2,733.00 in fulton county to a low of $314.00 in warren county.. Which County Has The Lowest Property Taxes In Georgia.

From www.seniorliving.org

Which States Have the Lowest Tax Rates? Which County Has The Lowest Property Taxes In Georgia Then you need to know your effective property tax rate. the exact property tax levied depends on the county in georgia the property is located in. Fulton county collects the highest property. georgia has 159 counties, with median property taxes ranging from a high of $2,733.00 in fulton county to a low of $314.00 in warren county. The. Which County Has The Lowest Property Taxes In Georgia.

From www.reddit.com

Which Cities Have the Highest and Lowest Property Taxes in the United Which County Has The Lowest Property Taxes In Georgia Fulton county collects the highest property. georgia has 159 counties, with median property taxes ranging from a high of $2,733.00 in fulton county to a low of $314.00 in warren county. you subtract your exemptions from your assessed value. 1 min read. Poulan, sumner, sylvester and warwick. 160 rows this interactive table ranks georgia's counties by. Which County Has The Lowest Property Taxes In Georgia.

From metroatlantaceo.com

Property Taxes Are 16.8 Of Tax Revenue, Above U.S. Average Which County Has The Lowest Property Taxes In Georgia 160 rows this interactive table ranks georgia's counties by median property tax in dollars, percentage of home value, and. Then you need to know your effective property tax rate. Fulton county collects the highest property. you subtract your exemptions from your assessed value. in georgia, for example, where the median property tax bill is relatively low, median. Which County Has The Lowest Property Taxes In Georgia.

From www.fair-assessments.com

Property Tax Appeal Blog property tax assessment Which County Has The Lowest Property Taxes In Georgia Fulton county collects the highest property. Smartasset’s latest study ranks the georgia counties with the lowest tax burdens, assessing income, sales, property, and fuel. the exact property tax levied depends on the county in georgia the property is located in. 160 rows this interactive table ranks georgia's counties by median property tax in dollars, percentage of home value,. Which County Has The Lowest Property Taxes In Georgia.

From www.mortgagecalculator.org

Median United States Property Taxes Statistics by State States With Which County Has The Lowest Property Taxes In Georgia The effective property tax rate is just 0.84%, well below the state. 1 min read. Poulan, sumner, sylvester and warwick. Fulton county collects the highest property. the exact property tax levied depends on the county in georgia the property is located in. georgia has 159 counties, with median property taxes ranging from a high of $2,733.00 in. Which County Has The Lowest Property Taxes In Georgia.

From www.nationalmortgagenews.com

24 states with the lowest property taxes National Mortgage News Which County Has The Lowest Property Taxes In Georgia the exact property tax levied depends on the county in georgia the property is located in. 160 rows this interactive table ranks georgia's counties by median property tax in dollars, percentage of home value, and. This section provides information on property taxation in the various counties in georgia;. Smartasset’s latest study ranks the georgia counties with the lowest. Which County Has The Lowest Property Taxes In Georgia.

From ceusptoh.blob.core.windows.net

What States Have The Lowest Estate Taxes at Dwight Allen blog Which County Has The Lowest Property Taxes In Georgia georgia has 159 counties, with median property taxes ranging from a high of $2,733.00 in fulton county to a low of $314.00 in warren county. in georgia, for example, where the median property tax bill is relatively low, median taxes range from $494 in quitman. the exact property tax levied depends on the county in georgia the. Which County Has The Lowest Property Taxes In Georgia.

From www.eastatlhomebuyers.com

Property Tax Liens Breyer Home Buyers Which County Has The Lowest Property Taxes In Georgia This section provides information on property taxation in the various counties in georgia;. Smartasset’s latest study ranks the georgia counties with the lowest tax burdens, assessing income, sales, property, and fuel. the exact property tax levied depends on the county in georgia the property is located in. The effective property tax rate is just 0.84%, well below the state.. Which County Has The Lowest Property Taxes In Georgia.

From sparkrental.com

Property Taxes by State & County Lowest Property Taxes in the US Mapped Which County Has The Lowest Property Taxes In Georgia This section provides information on property taxation in the various counties in georgia;. the exact property tax levied depends on the county in georgia the property is located in. Then you need to know your effective property tax rate. georgia has 159 counties, with median property taxes ranging from a high of $2,733.00 in fulton county to a. Which County Has The Lowest Property Taxes In Georgia.

From taxfoundation.org

Property Taxes by County Interactive Map Tax Foundation Which County Has The Lowest Property Taxes In Georgia The effective property tax rate is just 0.84%, well below the state. in georgia, for example, where the median property tax bill is relatively low, median taxes range from $494 in quitman. 160 rows this interactive table ranks georgia's counties by median property tax in dollars, percentage of home value, and. the exact property tax levied depends. Which County Has The Lowest Property Taxes In Georgia.

From my-unit-property-9.netlify.app

Real Estate Property Tax By State Which County Has The Lowest Property Taxes In Georgia you subtract your exemptions from your assessed value. Poulan, sumner, sylvester and warwick. Smartasset’s latest study ranks the georgia counties with the lowest tax burdens, assessing income, sales, property, and fuel. in georgia, for example, where the median property tax bill is relatively low, median taxes range from $494 in quitman. georgia has 159 counties, with median. Which County Has The Lowest Property Taxes In Georgia.

From exprealty.com

States with the Lowest Property Taxes in 2022 eXp Realty® Which County Has The Lowest Property Taxes In Georgia georgia has 159 counties, with median property taxes ranging from a high of $2,733.00 in fulton county to a low of $314.00 in warren county. This section provides information on property taxation in the various counties in georgia;. Fulton county collects the highest property. you subtract your exemptions from your assessed value. 160 rows this interactive table. Which County Has The Lowest Property Taxes In Georgia.